Two years on: AIIB’s list of achievements

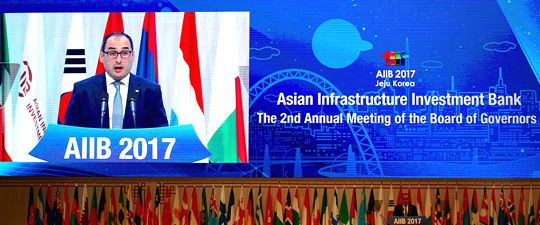

The scene of the second Annual Meeting of the Board of Governors of Asian Infrastructure Investment Bank.

From the beginning, the AIIB, a professional and efficient platform for infrastructure investment, has played a positive role in fundraising for regional infrastructure and promoting economic and social development. Since it was founded in December 2015, the organization has been involved in 24 investment projects with a total of $4.2 billion in project loans.

All the projects promoted by the AIIB focus on infrastructure construction and support the Belt and Road initiative. The projects involved 12 countries along the proposed routes of the initiative in Asia and Africa, including the Philippines, India, Pakistan, Bangladesh, Myanmar and Indonesia. The projects include renovating slums, flood control, natural gas pipeline construction, highway and rural roads, networks and power system in a bid to facilitate conditions of energy, transportation and urban construction.

There is great demand for infrastructure financing in Asia because infrastructure serves as the basis of a region’s economic development. However, it is difficult to mobilize investment in infrastructure because of its long cycle and high risks. Despite the tough conditions, the AIIB has played a leading role by emphasizing joint financing, knowledge sharing and capability improvement. At the same time, the multilateral development organization advocated complementary improvement, so that it could contribute more to the infrastructure networks connecting Asian countries and economic sustainability. The AIIB has helped its members develop high-quality infrastructure projects at low cost based on new global trends and individual demand in a bid to facilitate infrastructure conditions, thus driving economic development and serving people.

The AIIB has expanded its membership since President Xi Jinping’s initial proposal on Oct. 2, 2013. Currently, 84 members have joined the organization. “Our approved membership has risen from 57 to 84, expanding its reach within Asia and across the world,” said AIIB Vice-President Danny Alexander. The organization welcomes the participation of new friends at any time. Along with its increasing number of projects and growing attractiveness, the AIIB’s internal structure and operating mechanism have been optimized to keep pace with the times.

In terms of the internal structure of the investment bank, the voting rights of each member have three forms. Shareholder voting rights are determined by stake distribution. Also, each member has the same proportion of basic voting rights. And the founding members enjoy the third form of voting rights. Such an arrangement is a testament to fairness and justice, guaranteeing all members will follow commercial principles and produce the best voting results based on collective negotiation. For the first time in the history of finance, developing countries have voting majority within an international institution.

In addition, AIIB board members are keeping frequent and effective contact. The application of modern technology to operation helps to reduce the cost in management. The entire faculty in the organization strictly abide by procedures of work and limitations of rights with an emphasis on self-discipline and rules. In circumstances like this, operating concepts and decision-making mechanism of the AIIB have invited fairness, efficiency and purity. It is noticeable that China, as a founding member and the largest shareholder of the AIIB, doesn’t command the right to make final decisions. Stake and voting rights of China and other founding members will gradually be reduced in response to the participation of more members.

In 2017, the AIIB won the highest credit ratings of Moody’s, Standard & Poor’s and Fitch, reflecting global investors’ confidence about the role of the AIIB in driving future investment, financing and globalization.

The international market has extensively recognized the AIIB in the past two years for its scientific development concepts, management pattern, adequate capital flow and stable stake structure. It is destined to play a bigger role in promoting investment and financing of global infrastructure construction based on appropriate leverage ratio and credit quality, according to a report of Moody’s. Standard and Poor’s estimated that the excellent business performance and financial condition allows AIIB to tackle credit risks while generating greater profits. Fitch also predicted that the AIIB has the potential to be an emerging multilateral lending organization that is trusted by sovereign countries and global investors. Other renowned international financial organizations, such as the Basel Committee on Banking Supervision and the New Asian Development Bank, also applauded the AIIB’s contributions to addressing the shortage of infrastructure funding, stimulating the recovery of global economy and promoting balanced development among countries and regions.

In 2018, the AIIB will continue to expand its infrastructure investment and financing projects, injecting strong momentum into the economic development of target countries and regions across the world. At the same time, it plans to enter the international capital market and issue global bonds in Europe, offering a new brand of high-yield products and quality services to global investors.

The article was translated from Guangming Daily.

(edited by MA YUHONG)