Hangzhou’s leading startups exemplify effective innovation ecosystem

Photo generated by CSST

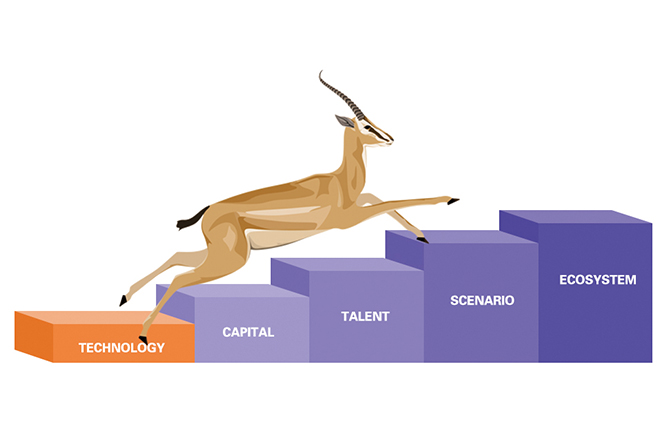

In early 2025, Hangzhou’s “Six Little Dragons,” represented by firms like Unitree Robotics and DeepSeek, successfully made waves worldwide, epitomizing the deep involvement of Chinese private high-tech firms in—and even reshaping of—the competition landscape of the global AI industry. What accounts for the clustered breakthroughs in key AI technologies? According to innovation economics and innovation ecosystem theory, such “zero-to-one” breakthroughs are not the result of any single factor, but rather the overall power of a private sector-led, innovation-driven entrepreneurship ecosystem. Constructing such an ecosystem—with private tech firms at the core and innovation elements, actors, capabilities, and capital as its basic framework—can provide fertile ground for clustered breakthroughs in the AI industry.

First-class human, financial resources hold key

First, tech entrepreneurs are the soul of “creative destruction.” The core value of entrepreneurs lies in their role as carriers of heterogeneous human capital, breaking traditional techno-economic paradigms through creative destruction. Tech firms must possess a strong sense of adventure alongside unique competence in opportunity recognition. Entrepreneurs like DeepSeek’s Liang Wenfeng and Unitree Robotics’ Wang Xingxing exemplify the new generation of private tech leaders who have spent decades investing in research and development (R&D), exploring frontier technologies, and recruiting top-tier talent regardless of cost. Why emphasize “tech”? Because breakthroughs in frontier technologies are often driven by science-based entrepreneurship. Tech entrepreneurs require not only commercial expertise but also a strong scientific mindset and a solid foundation in basic and theoretical knowledge—qualities that clearly distinguish them from traditional entrepreneurs. And why emphasize “private”? Because private tech entrepreneurs have the most distinct sense of mission and motivation for innovation. They stake their own wealth and future on innovation, with the determination to either succeed or perish.

Second, private tech enterprises serve as the collaborative engine for clustered breakthroughs in industrial technology. Globally, hopes for zero-to-one breakthroughs in core technologies in key fields are increasingly placed on private enterprises. In regions with a strong private sector, the allocation of innovation resources tends to be more effective, and firms enjoy institutional advantages when investing in high-risk technologies, as such innovation almost entirely depends on private capital. Zhejiang—and Hangzhou in particular—has unique strengths in this regard. For example, more than one-fifth of China’s top 500 private enterprises are based in Zhejiang; the province also consistently ranks first in the number of individuals on China’s wealth rankings, accounting for nearly one-fourth of the list. In conversations with executives from firms like DeepRobotics, Unitree Robotics, and Game Science, they made clear that a major reason for choosing Hangzhou was the strength of its private sector and the relatively open market environment.

Third, young tech talent is the pivotal force behind frontier innovation and entrepreneurship. The concentration of innovation-driven young professionals provides the most valuable resource for cutting-edge technological progress. Almost without exception, the R&D backbone of Hangzhou’s “Six Little Dragons” consists of individuals around the age of 30. For example, the majority of DeepSeek’s R&D team holds master’s or doctoral degrees, with members coming from top global universities. The gathering of young talent in Hangzhou in recent years owes much to the city’s booming internet and digital economy, as well as to the presence of companies like Alibaba, which have attracted elite innovators from around the world.

Fourth, tech-finance integration supplies fresh “blood” for the high-quality development of innovative tech enterprises. Pioneering and disruptive innovation is a high-stakes gamble—most startups lack the resources or creditworthiness for bank loans and instead rely on successive rounds of venture capital. Thus, regions that successfully intertwine capital chains with innovation and talent chains are most likely to achieve technological breakthroughs. Zhejiang, one of China’s most dynamic hubs for the private sector, boasts formidable private financial strength and has cultivated a “Zhejiang Corps” of 46 listed companies on the STAR Market. Leveraging its trillion-scale industrial innovation ecosystem—anchored by “chain-leading enterprises + innovation platforms” in AI and the Internet of Things—Hangzhou has brought together China’s most powerful private tech-finance network. Combined with government-guided funds that generate a 1:7 leverage effect with social capital, this ensures a continuous stream of financial support for the growth of tech startups.

Advanced digital infrastructure as hardware foundation

Digital technology infrastructure serves as the hardware foundation for clustered technological breakthroughs. Zhejiang’s advanced digital infrastructure system, born of the deep integration of digital technologies and AI, ranks among the nation’s best and holds considerable global influence. Notably, Alibaba, a world-leading digital platform enterprise, provides comprehensive empowerment to Hangzhou’s AI industry. Innovation centers like Hangzhou Future Sci-Tech City and Binjiang High-Tech Zone—home to the “Six Little Dragons”—all benefit from Alibaba’s digital infrastructure platform.

For instance, Alibaba’s dual-engine strategy of “cloud intelligence + globalization” features cloud computing infrastructure spanning 30 regions worldwide, supporting over a trillion daily AI calls. Similarly, Manycore Tech’s cloud-collaborative design platform serves more than 200 countries and regions, with its interactive 3D database surpassing 320 million models—not only reshaping the path of manufacturing digitalization but also establishing Chinese standards for spatial intelligence. Hangzhou’s leading-edge digital innovation infrastructure enables countless small and medium-sized tech firms to transition from incremental tool upgrades to transformative paradigm shifts, positioning the city as a future global hub for AI innovation.

Policy-friendly environment as software guarantee

A world-class, open, and inclusive business environment acts as the software guarantee for cluster-based technological breakthroughs. The deep coupling of market mechanisms and innovation ecosystems allows private enterprises to precisely seize technological inflection points, continuously pushing boundaries in a virtuous cycle where “demand drives innovation and innovation creates markets.”

From an institutional policy perspective, the rise of the “Six Little Dragons” reflects the synergy between an “effective market” and a “proactive government.” At all levels, the Zhejiang government adheres to legal and ethical principles while appropriately relaxing regulations, avoiding “excessive” interventions, and granting entrepreneurs the freedom to explore uncharted territories—at the same time providing targeted, enabling services to bolster entrepreneurial activities.

The province is also actively developing failure-tolerant, risk-sharing mechanisms for tech innovation and has established a 100-billion-yuan innovation mother fund to provide long-term capital backing. It continuously refines high-efficiency governance models, implementing digital reforms like “data-based land allocation” and “cloud-based evaluation” to boost administrative approval efficiency by 60%. This approach embodies a clear boundary awareness (“no unwarranted interference”), a service-first mindset (“always on call”), and institutional innovation (“comprehensive support”), reflecting a shift in the role of the government from “regulators” to “guardians.”

By fostering collaboration among entrepreneurs, incumbent firms, government agencies, research institutions, and intermediaries, Zhejiang has turned solo tech ventures into collective endeavors, ensuring that innovators no longer fight alone but thrive together.

Wei Jiang is a professor and president of Zhejiang University of Finance and Economics (ZUFE). Wang Zhengxin is a professor from the School of Economics at ZUFE.

Edited by CHEN MIRONG